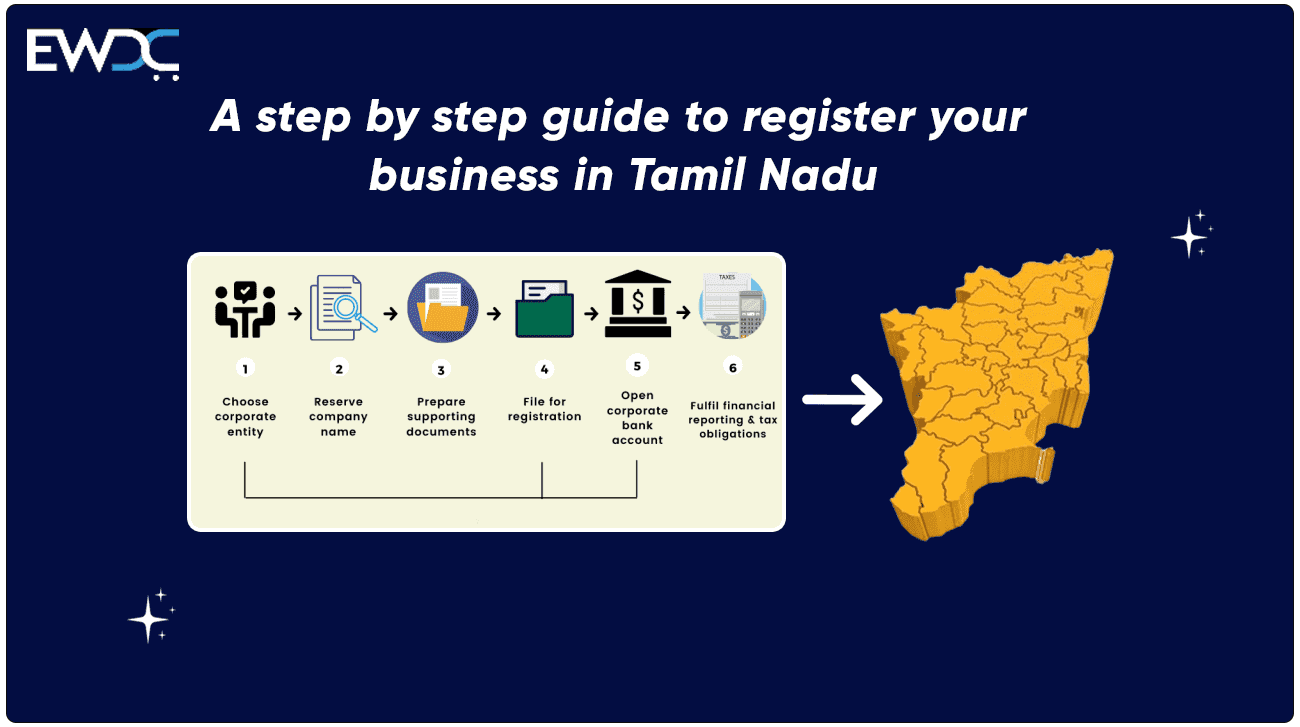

Tamil Nadu is one of the most industrialized and economically developed states in India, with a vibrant and diverse MSME sector. If you are planning to start a business in Tamil Nadu, you will need to follow certain legal steps and procedures to register your business and obtain the necessary licenses and permits. In this blog, we will provide you with a step-by-step guide to registering your business in Tamil Nadu, along with some useful tips and resources.

Before you register your business in Tamil Nadu, you will need to decide on the following aspects:

Depending on these factors, you will have to choose the appropriate registration authority and process for your business.

Some of the common types of business entities in India are:

A single person owns and operates the business, with unlimited liability and minimal compliance requirements.

Two or more persons agree to share the profits and losses of the business, with unlimited or limited liability and moderate compliance requirements.

A hybrid of partnership and company, where the partners have limited liability and flexibility in management and operations, with moderate compliance requirements.

A separate legal entity, where the shareholders have limited liability and the directors manage the business, with high compliance requirements.

A type of private limited company, where a single person is the sole shareholder and director of the business, with high compliance requirements. You can choose the type of business entity that suits your needs and objectives, and consult a professional advisor if needed. Once you have decided on the type of business entity, you can proceed to register your business in Tamil Nadu.

If you are registering your business as a LLP, a private limited company, or an OPC, you will need to obtain a Digital Signature Certificate (DSC) and a Director Identification Number (DIN) for yourself and your partners or directors. A DSC is an electronic signature that authenticates your identity and documents online, while a DIN is a unique identification number that is assigned to every director of a company or LLP.

You can apply for a DSC and a DIN online through the Ministry of Corporate Affairs (MCA) portal. You will need to fill out an online application form and upload the required documents, such as identity proof, address proof, and photographs. You will also need to pay a nominal fee for the DSC and the DIN. The DSC and the DIN are usually issued within 1-2 days of the application.

The next step is to reserve a name for your business entity. The name of your business should be unique, distinctive, and relevant to your business activity. You should also avoid any names that are similar or identical to existing businesses, trademarks, or domain names.

You can check the availability of your desired name online through the MCA portal or the Trademark Registry portal.

You can also use the RUN (Reserve Unique Name) service on the MCA portal to submit an online application for name reservation. You can propose up to two names for your business entity, along with a brief description of your business activity and the significance of the name. You will also need to pay a nominal fee for the name reservation. The name reservation is usually approved or rejected within 1-2 days of the application.

Once you have reserved a name for your business entity, you can proceed to register your business entity with the relevant authority. The registration authority and process may vary depending on the type of business entity you have chosen. Here are some of the common registration authorities and processes for different types of business entities in Tamil Nadu:

There is no separate registration process for a sole proprietorship in Tamil Nadu. However, you may need to obtain a trade license from the local municipal corporation and a GST registration from the Central Board of Indirect Taxes and Customs (CBIC) portal to operate your business legally and tax-efficiently.

You may also need to register with other authorities depending on the nature and location of your business activity, such as the Shops and Establishments Act, the Professional Tax Act, the Employees’ Provident Fund Organisation (EPFO), the Employees’ State Insurance Corporation (ESIC), etc.

To register a partnership in Tamil Nadu, you will need to draft a partnership deed that outlines the terms and conditions of the partnership, such as the name, address, and capital of the partnership, the names and addresses of the partners, the profit and loss sharing ratio, the duration and dissolution of the partnership, etc. You will also need to obtain a PAN card and a GST registration for your partnership.

You can then register your partnership with the Registrar of Firms (RoF) of Tamil Nadu by submitting an online application form and uploading the required documents, such as the partnership deed, the identity and address proofs of the partners, the affidavit of the partnership, etc. You will also need to pay a nominal fee for the registration. The registration of the partnership is usually completed within 7-10 days of the application.

To register a LLP in Tamil Nadu, you will need to draft a LLP agreement that outlines the terms and conditions of the LLP, such as the name, address, and capital of the LLP, the names and addresses of the partners and designated partners, the profit and loss sharing ratio, the rights and duties of the partners and designated partners, the management and administration of the LLP, etc. You will also need to obtain a PAN card and a GST registration for your LLP.

You can then register your LLP with the MCA portal by submitting an online application form and uploading the required documents, such as the LLP agreement, the DSC and DIN of the partners and designated partners, the identity and address proofs of the partners and designated partners, the consent letters of the partners and designated partners, the proof of the registered office of the LLP, etc. You will also need to pay a nominal fee for the registration. The registration of the LLP is usually completed within 15-20 days of the application.

To register a private limited company or an OPC in Tamil Nadu, you will need to draft a memorandum of association (MoA) and articles of association (AoA) that outline the objectives and rules of the company, such as the name, address, and capital of the company, the names and addresses of the shareholders and directors, the main and ancillary objects of the company, the shareholding and voting rights of the shareholders, the powers and responsibilities of the directors, the meetings and resolutions of the company, etc. You will also need to obtain a PAN card and a GST registration for your company.

You can then register your company with the MCA portal by submitting an online application form and uploading the required documents, such as the MoA and AoA, the DSC and DIN of the shareholders and directors, the identity and address proofs of the shareholders and directors, the consent letters of the shareholders and directors, the proof of the registered office of the company, the declaration of the compliance of the company, etc. You will also need to pay a nominal fee for the registration. The registration of the company is usually completed within 15-20 days of the application.

After you have registered your business entity, you may need to obtain other licenses and permits depending on the nature and location of your business activity.

Some of the common licenses and permits that you may need to obtain are:

A trade license is permission granted by the local municipal corporation to carry out a specific trade or business activity within its jurisdiction. The trade license ensures that the business activity complies with the health, safety, and environmental norms and regulations. You can apply for a trade license online through the respective municipal corporation website by submitting an online application form and uploading the required documents, such as the identity and address proofs of the business owner, the proof of the business entity registration, the proof of the business premises, the NOC from the fire department, the NOC from the pollution control board, etc. You will also need to pay a nominal fee for the trade license. The trade license is usually issued within 15-30 days of the application.

Professional tax is a tax levied by the state government on the income of professionals and salaried employees. The professional tax rates and slabs vary from state to state and depend on the income level of the individual. In Tamil Nadu, the professional tax rates range from Rs. 16.67 to Rs. 200 per month, depending on the income level of the individual. You can register for professional tax online through the Commercial Taxes Department of Tamil Nadu portal by submitting an online application form and uploading the required documents, such as the identity and address proofs of the business owner, the proof of the business entity registration, the PAN card of the business entity, the bank account details of the business entity, the list of employees and their salaries, etc. You will also need to pay a nominal fee for the professional tax registration.

The final step is to file your tax returns and comply with the relevant authorities regularly. Depending on the type and nature of your business activity, you may need to file the following tax returns and compliances:

Income tax is a tax levied by the central government on the income of individuals and businesses. You can file your income tax return online through the Income Tax Department portal by submitting the relevant income tax form and uploading the required documents, such as the PAN card of the business entity, the profit and loss account and balance sheet of the business entity, the audit report of the business entity, the tax deducted at source (TDS) certificates, the proof of the tax payments, etc. You will also need to pay the applicable income tax as per the income tax rates and slabs. The income tax return is usually due by July 31 of the assessment year for non-audited businesses and by September 30 of the assessment year for audited businesses.

GST is a comprehensive indirect tax levied by the central and state governments on the supply of goods and services. You can file your GST return online through the CBIC portal by submitting the relevant GST form and uploading the required documents, such as the GST registration certificate of the business entity, the sales and purchase invoices of the business entity, the GST payment challans, the GST refund claims, etc. You will also need to pay the applicable GST as per the GST rates and slabs. The GST return is usually due by the 20th of the following month for monthly filers and by the 18th of the following month for quarterly filers.

RoC compliances are the statutory compliances that are required to be filed by the companies and LLPs with the Registrar of Companies (RoC) of Tamil Nadu. You can file your RoC compliances online through the MCA portal by submitting the relevant RoC forms and uploading the required documents, such as the annual return of the company or LLP, the financial statements of the company or LLP, the appointment or resignation of the directors or partners, the changes in the share capital or ownership of the company or LLP, the board meeting minutes and resolutions of the company or LLP, etc. You will also need to pay the applicable RoC fees and penalties. The RoC compliances are usually due by March 31 of the financial year for annual filings and within 30 days of the event for event-based filings.

Conclusion

Registering your business in Tamil Nadu is a simple process if you follow the steps and procedures mentioned above. By registering your business, you can enjoy the benefits of legal recognition, tax benefits, funding opportunities, and customer trust.

However, registering your business is not enough; you also need to maintain and grow your business by providing quality products and services, managing your finances and operations, marketing your brand, and complying with the laws and regulations. We hope this blog has helped you understand how to register your business in Tamil Nadu and inspired you to start your entrepreneurial journey.